Budgeting Without Shame

Are you constantly trying to stay just one step ahead of your bills? A budget can help you organize your finances. It is really surprising, but a budget can save time and a lot of worries.

Many people think of a budget as a financial jail or a diet. They eventually fail at their budgeting because of this. You have to think of a budget as simply a way to see where you spend your money and a plan that helps you get the things that you want.

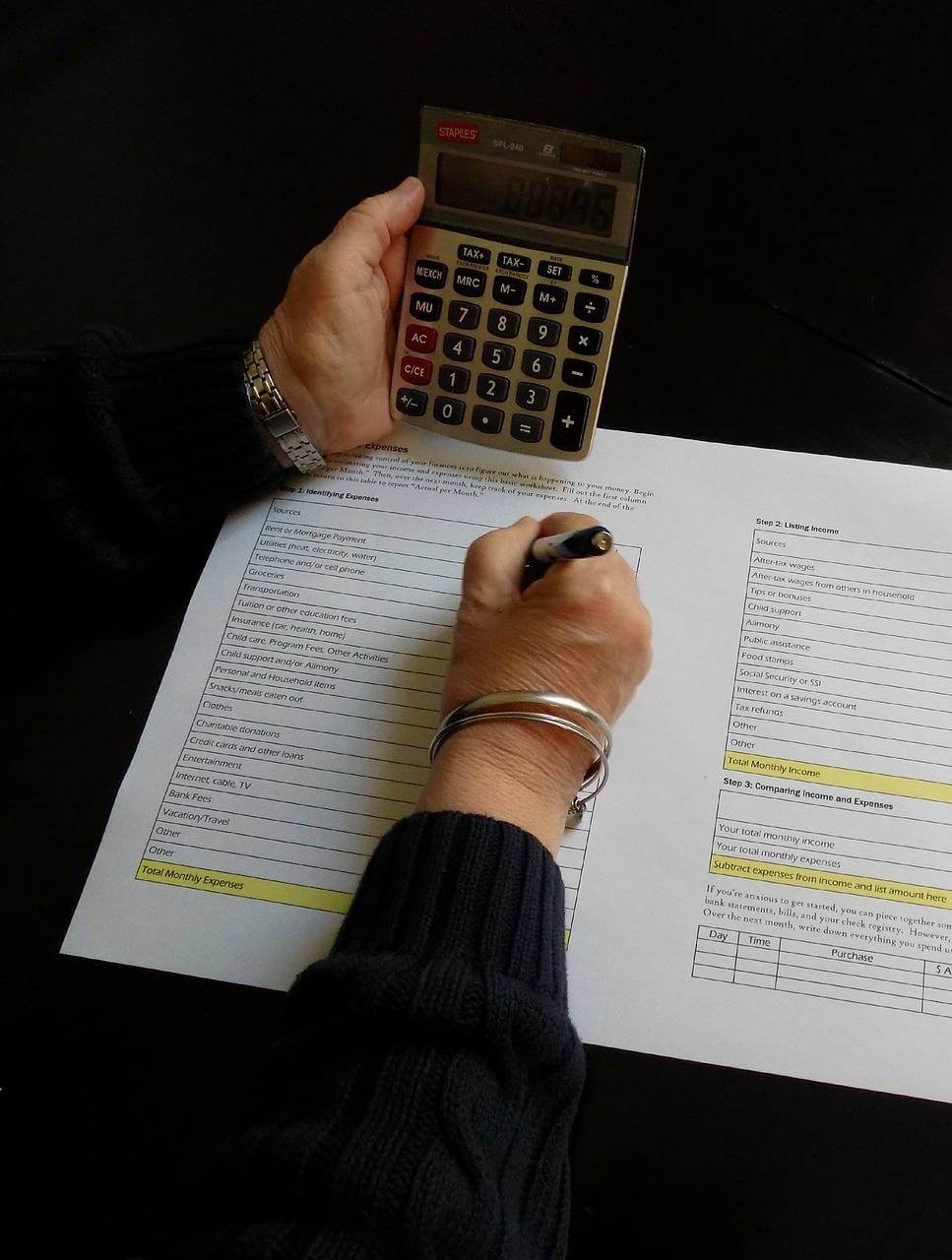

First, you have to create your basic budgeting template. You have to look at the way you spend your money (not some computer’s predetermined amounts) to be able to successfully budget. Start with your income, which is easy to identify.

Then move on to identifying your spending and expenses. Start with your bills. List each one and the amount that you pay. You might want to go ahead and add interest rates and payoff amounts to any of the debts so that you can get a head start in identifying what you need to pay off first.

Then move on to the basics, such as groceries and car expenses. If you eat out every day for lunch, include this category in your spending. If you have a hobby that you regularly shop for, include this category. Identify the places your money goes during the month.

You can use a template budget worksheet, found online or in a bookstore. Make sure that you edit this worksheet to fit your finances and your needs.

Now you need to identify your budget amounts. Collect your receipts and bills for the past month. This is easy to do. Simply get a receipt for everything you purchase and dump it in a shoebox at the front door every evening when you come in. Go through these receipts and start filling in the spending category amounts. You may find that you need to even add more categories.

For the next two or three months, you should consider simply tracking your spending to get a realistic vision of how you spend. You may immediately find that you can cut spending in some areas. Often, people are surprised to know that they spend so much on something.

Once you have an idea of where your money is going, you can start cutting back in certain areas. Everything is negotiable. Even seemingly fixed expenses, such as your electric bill or water bill, can be reduced.

Remember, your budget isn’t something designed to limit your spending. It is created to let you manage your spending. You can get an accurate view of how you spend. There isn’t anything to be guilty about or ashamed about when you see how your money is being spent. Now you can see how to fix it.

It's $0.99 from your spare change to give credits to our writers and providers that bring this awesome resource to you. Your little change makes all the difference. Your donation shows appreciation.

Join

Subscribe For Updates & Offers

Receive a notification on news and updates on all special offers.